Weekly Technical Report

Weekly Technical View on NIFTY, BANK NIFTY, USD/INR, GOLD, CRUDE, CRYPTO

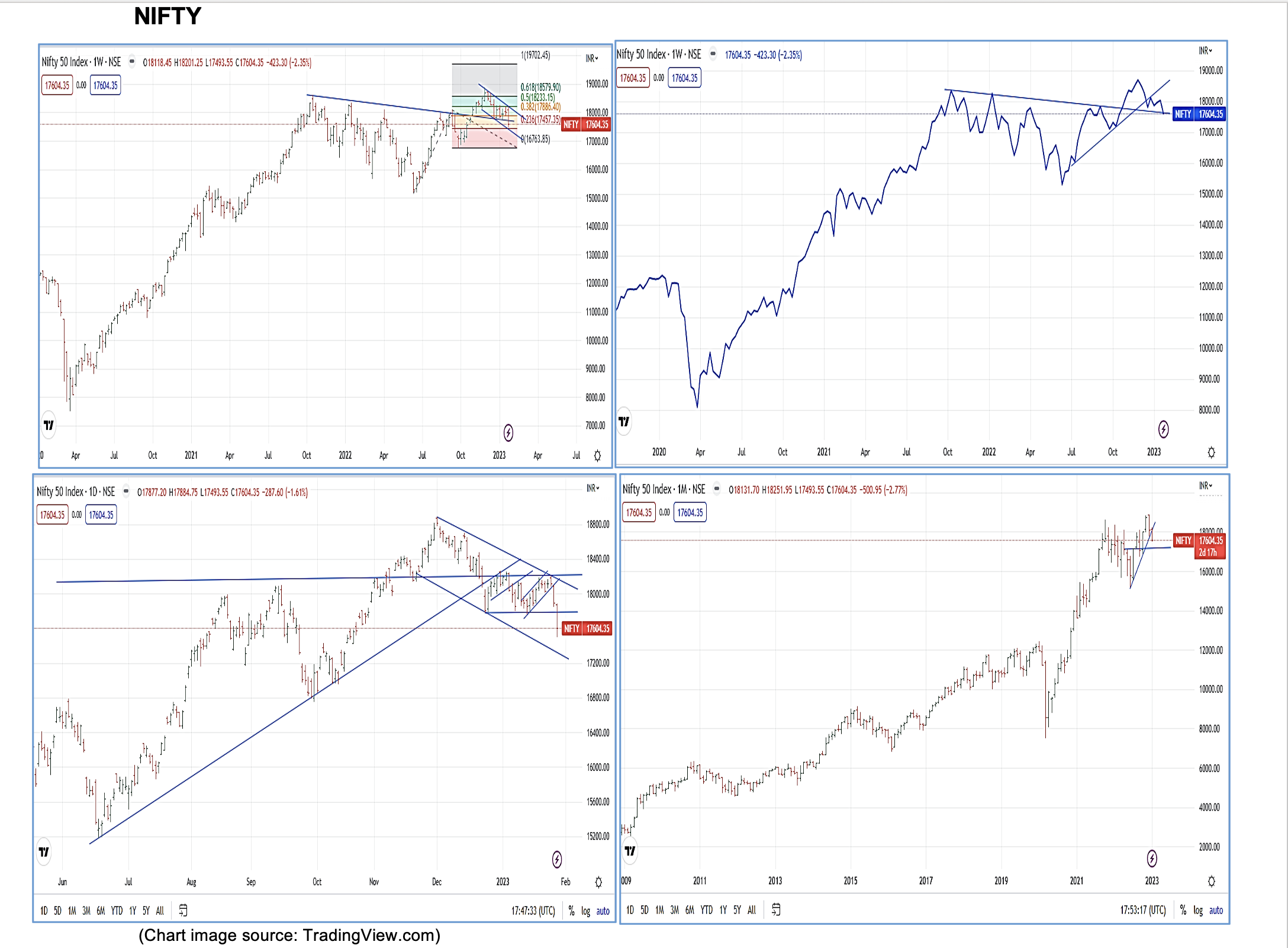

NIFTY :- The continuous failure of the main Index Nifty to hold above 18100 coupled with Monthly expiry related option exposure brought down the levels to 17900. The final hope of 17770 breach was triggered by media reports on governance issues relating to one of the major corporates. The penetration was deeper due to multiple stops getting triggered both on Main index and the Bank Nifty. Nifty ended up with a bearish candle on the weekly charts.

A few observations from the weekly charts are:

- Weekly charts suggest that

- The index moved around 708 points viz. between 17493 and 18201

- The oscillators are showing negative signals

- 17770-880 will become a resistance zone

- Expected scenarios for the ensuing week

- Though closed at 17607, every spike is expected to be sold-off

- For the ensuing week, the index may find supports at 17460, 17350 and the index could face resistances at 17770, 17840, 17940

- Additional interesting observations

- Below 18k and below 17960 the most likely scenario could be test of lower levels towards 17070 over the course of next couple of weeks

- Expected to remain in the range of 17320-17940 and any close outside the range requires re-assessment of risk

- Below 18k and below 17960 the most likely scenario could be test of lower levels towards 17070 over the course of next couple of weeks

US Markets

- DOW appears to have made a strong base at 33400

- Expect a stronger move towards 34500

- Expect the range of 33600-34600 to continue

- Final Note

- Our apprehension in the previous Blog that for any reason the support at 17770 breaks, then we may see a deeper fall which has happened

- The crucial zone of 17770-17860 would become a resistance zone

- With just two sessions for the monthly closing candle and the with the kind of negative sentiments prevailing, the Index will face herculean task to scale 18k or higher.

- There had been multiple Gaps created during the up move

- 17320-17430

- 16650-16770

- 16360-16560

- Final Note

(These are risk zones which might pull the Index down)

- Just a couple of sessions/weeks make markets to change perceptions

- We have been highlighting the below scenario all through the month of Nov and Dec 22

- If we take the Fib retracements so far the correction has been 1283 points. The Annual gain has been 3704 points from 15183 to 18887. One third correction would fall at 17666 and a 50% correction would mean 17035

- The present scenario seems to be suggesting a deeper correction which can only be negated if the Index can manage to close above 18100 in the first couple of sessions which appears to be a remote possibility, at least for now

- If we take the Fib retracements so far the correction has been 1283 points. The Annual gain has been 3704 points from 15183 to 18887. One third correction would fall at 17666 and a 50% correction would mean 17035

Bank Nifty:- The Bank Nifty had a sharp move with a wide range of 2930 points Viz. between 43078 & 40148 and made a bearish candle. The Bank Nifty faced strong selling pressure on breach of trend line support at 42370. Every spike there after got sold-off and gained further momentum when it breached 41700 which was holding for five weeks. The scenario for now appears to be negatively biased. Bank Nifty is likely to target lower levels with 41500 & 42100 as strong resistance levels. As observed in the previous blog the Bank Nifty is likely to drift towards 39800 and then 38600.However, there could be relief rally towards 41500 or higher which is likely to be sold-off. Expected range for Bank Nifty is 38800-41500. The fall has triggered increased volatility which is likely to continue though the next month. A daily close outside the broader range indicated above would require re-evaluation.

USD/INR :- The pair took support at 80.90 and made an attempt to scale higher of 81.76 levels, it got sold-off again. The support at 80.90 is a tuff nut to crack and may consolidate in the range of 80.90 & 82.05 with choppy moves on either side. A close above 81.75 can be treated as a reversal for re-attempt of 82.55. Only a break below 80.90 can see the pair drift towards 80.50 and then to 80.20. Most likely scenario would be a consolidation between 80.90 and 82.05. A close outside this range requires re-assessment of risk/direction and target.

A few more observations:

- The currency pair trying to attempt the break-down levels in the reactive move

- The correlation between DXY and USDINR is not currently active

- though the Dollar Index-DXY is likely to hover in the familiar range of 101-105

- The raising upward channel indicate the broader range of 80.10-83.10

- The increased volatility and wild swings likely to continue

Gold :-

As expected there has been selling pressure around 1950 zone. There is still one chance for the Precious metal to attempt 1990 if it manages to close above 1950. Failed attempt would see the metal drift lower towards 1890. We can safely assume that the consolidation range got shifted higher with a band of 1860-1970 with 1910 acting as Pivot.

Crypto :-

They crypto assets have continued its gain and could manage to cover the highs of July 2022. Now that it has reached another crucial juncture. The daily charts suggest a breather for correction lower before resuming the trend. The reactive pull backs are likely to be supported by fresh buying interest. The appreciation is likely to continue till it achieves the June 2022 highs. Technically there are chances that it might manage to cross June high. Whether all negatives surrounding the Crypto assets is cleared is a big question. Yet there are chances that this move may help to regain the confidence of the investors.

Crude :-

Crude was seen in a narrow range of 78-82. It remains to be seen how the monthly closing happens to decide future range. The technical indicators point to a surge in crude price towards 95 levels. This could be due to change in perception about the revival of economic activities subsequent to encouraging inflation data. Any close below 75 could delay the possible move higher and may re-attempt of 65 zone. The range of 75-85 is considered safe and beneficial for revival. Sounds safe for now as long as we see the crude move in this range of 70-90. Either extremes are likely to hurt the economic activities and the outlook.