Weekly Technical View

Weekly Technical View on NIFTY, BANK NIFTY, USD/INR, CRUDE, CRYPTO

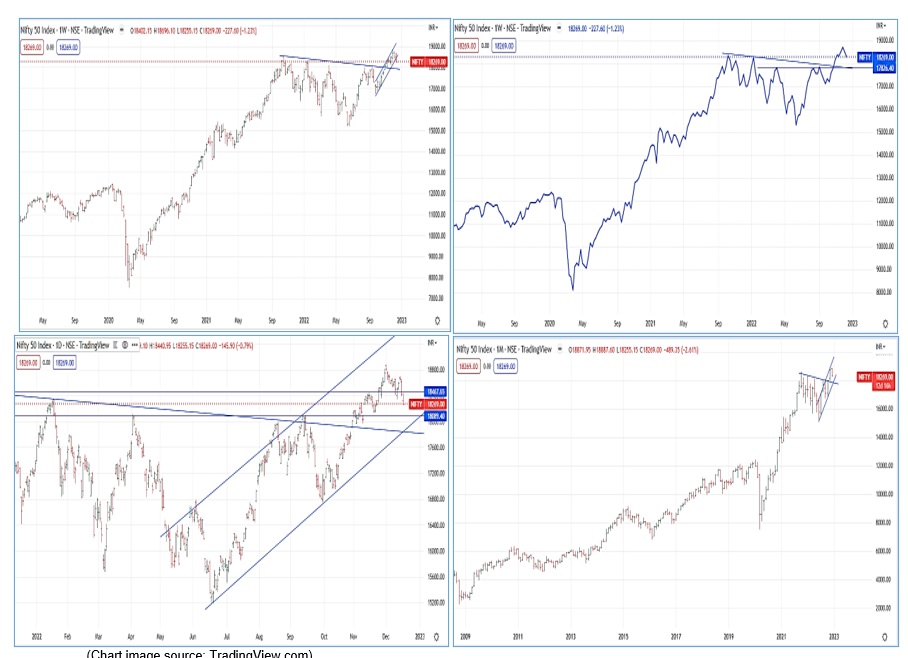

NIFTY :-

Nifty has been on steady decline for the second week. Past week resulted in formation of another bearish candle. While the consolidation at every stage is a healthy sign, it appears that the Nifty is showing signs of weakness ahead of the year end.

A few observations from the weekly charts are:

- Weekly charts suggest that

- The index moved around 440 points viz. between 18255 and 18696

- the oscillators are showing negative bias

- Option OI is expected to drive the market direction

- The Index made lower highs and lower lows and it ended up with a bearish candle

- Expected scenarios for the ensuing week

- Most likely scenario could be a consolidation between 18300 and 18770

- Though closed at 18269, the Index is expected to open higher

- As expected the Index moved lower towards 18250 on break of crucial Trend line support at 18400.

- Further the weekly closing is near the lows which is supportive of the negative bias. However, it is too early to conclude that the trend has completely reversed

- The zone between 18400-18600 has been a slippery wicket and witness a sharp move on either side

- The final support hinges at 17860-17940 zone.

- For the ensuing week, the index may find supports at 18160, 18040, 17960 and the index could face resistances at 18420, 18550 and 18670

- A daily close above 18460 required for keeping the hopes alive for re-attempt of ATH.

- Additional interesting observations

- The reversal from new ATH to breach previous Fib support of 18530 is considered negative

- Both FIIs and DIIs seem to be net negative (possibly on profit booking)

- Two possible scenarios

- Expected range of 17960-18420 or 18170-18550

- Any close outside the range of 17960-18550 requires re-assessment of risk

- US Markets

- DOW saw a volatile week which saw both the highs and lows of the current month. While the closing is 32920 which is near the lows. It needs to be noted that the high of 34700 is almost the high in the past six months.

- We can safely assume that the Inv H&S target of 35K is almost achieved with marginal +/- allowance. However, it could not sustain the levels

- The current move seems to be profit booking towards the trend line break zone of 32.2K

- US Tech stocks which saw some recovery is hammered again

- Final Note

- It so happens that when a long term trend line is breached and the prices reach a new peak, there would be profit booking which brings down the price as close to the break-out levels. We are currently in this scenario and we can expect the move to drag the NIFTY towards 17960.

- If for any reason we see a closing below 18170 then there are chances that we may see further correction towards 17960

- This week will be crucial to see whether Bulls meekly surrender their grip and the we are looking at a scenario of start of a bear cycle in the New Year.

- There are higher possibilities of churning of portfolio

- Possibly the last weekly Blog for 2022.

Bank Nifty:-

The Bank Nifty managed to post a new ATH.of 44151 and saw a strong sell-off which made the index to loose about 1K points. There has been a varied price action within the components. We see the Index continuing to move in a channel with top at 44250 and lower end at 42200 with a pivot at 43100. The weekly candle coupled with the Oscillators paint a negative picture. There may be hurdles at 43600-43900 range. This week is crucial to see whether the Bank Nifty breaks the barrier and makes another new high or breaks down. We can assume that the trend still remains positive till we see a close below the trend line support at 42200. It appears that the Bank Nifty is likely to continue in a wider range of 42200-44200 with 43100 as pivot and a breach and close above or below could see the next range of 900 points. For now, Bank Nifty continues to be in a trading range. A daily close outside the broader range indicated above would require re-evaluation. It is worth noting that for any correction first requirement would be a daily close below 42900.

Note: Tough times ahead as we see a bit of slow-down in the pace of advancement and a tuff barrier seen around 43800-44050 range. Need to exercise caution. PSU banks may provide opportunities for Fresh entry levels on a deeper correction.

USDINR:-

The pair moved in a range of 81.37-82.96 during last week. The pair seem to be in a dilemma and un-willing to breach either side. We may see one more week of narrow range of 83.10-82.40. While the monthly candle is still in progress, it appears that the pair may make one more attempt of the trend line resistance at 83.30. Deeper corrections cannot be expected till we see a close below 81.20. We can expect supply around the closer resistance at 83.10. This seems to be another phase where the demand is led by lower crude and other unhedged imports getting covered. Most likely scenario would be a consolidation between 82.20 and 83.20. A close outside this range requires re-assessment of risk/direction and target.

A few more observations:

- The long term trend line till at 83.10-83.30 levels holds for now and we are likely to see a consolidation between 79-82

- We may not see a runaway in DXY. We have once seen the support at 105 giving-up. There can be relief rallies.

- Full impact of the correction has not yet been seen in USDINR currency pair. Hence, the spikes in DXY need not necessarily impact this pair

- The raising upward channel indicate the broader range of 80.10-83.10

- The increased volatility and wild swings likely to continue

Gold:-

The precious metal is seen consolidating in the range of 1770-1830. Though the outlook is expected to be positive, there are chances that the precious metal may see a pull back towards 1740-1725 range which might be seen as another opportunity for fresh long build-up. Gold is regaining the lost luster aided by the uncertainties surrounding the Crypto assets. A daily close above 1810 would see further gains towards 1840+ For now, it appears like a consolidation between 1760-1840.

Crypto:-

For the fifth consecutive weeks the Crypto assets have seen a narrow range consolidation. We are witnessing quick surge and sell-off. We had a huge Gap during the upswing in November 2020. That is the cause of worry as technically there are chances of the Gap getting filled. Only a strong 20% sharp move can possibly help to regain the footing. Even under such circumstances we may see a bout of selling pressure.

Crude:-

The Oil settled in a narrow range of 71-77. The previous weeks fall towards 72 levels was a cause of concern. The long term median line is 75. Technically, there seems a possibility of the Crude drifting to 50s if 68 gives-up. Ideal scenario would be that the crude finds its sweet spot between 72 & 82. We may see sudden spikes and subsequent cooling-off within this range. There are many uncertainties on the demand and winter worries. Sounds safe for now as long as we see the crude move in this range of 70-90. Either extremes are likely to hurt the economic activities and the outlook.