Weekly Technical Report

Weekly Technical View on NIFTY, BANK NIFTY, USD/INR, GOLD, CRUDE, CRYPTO

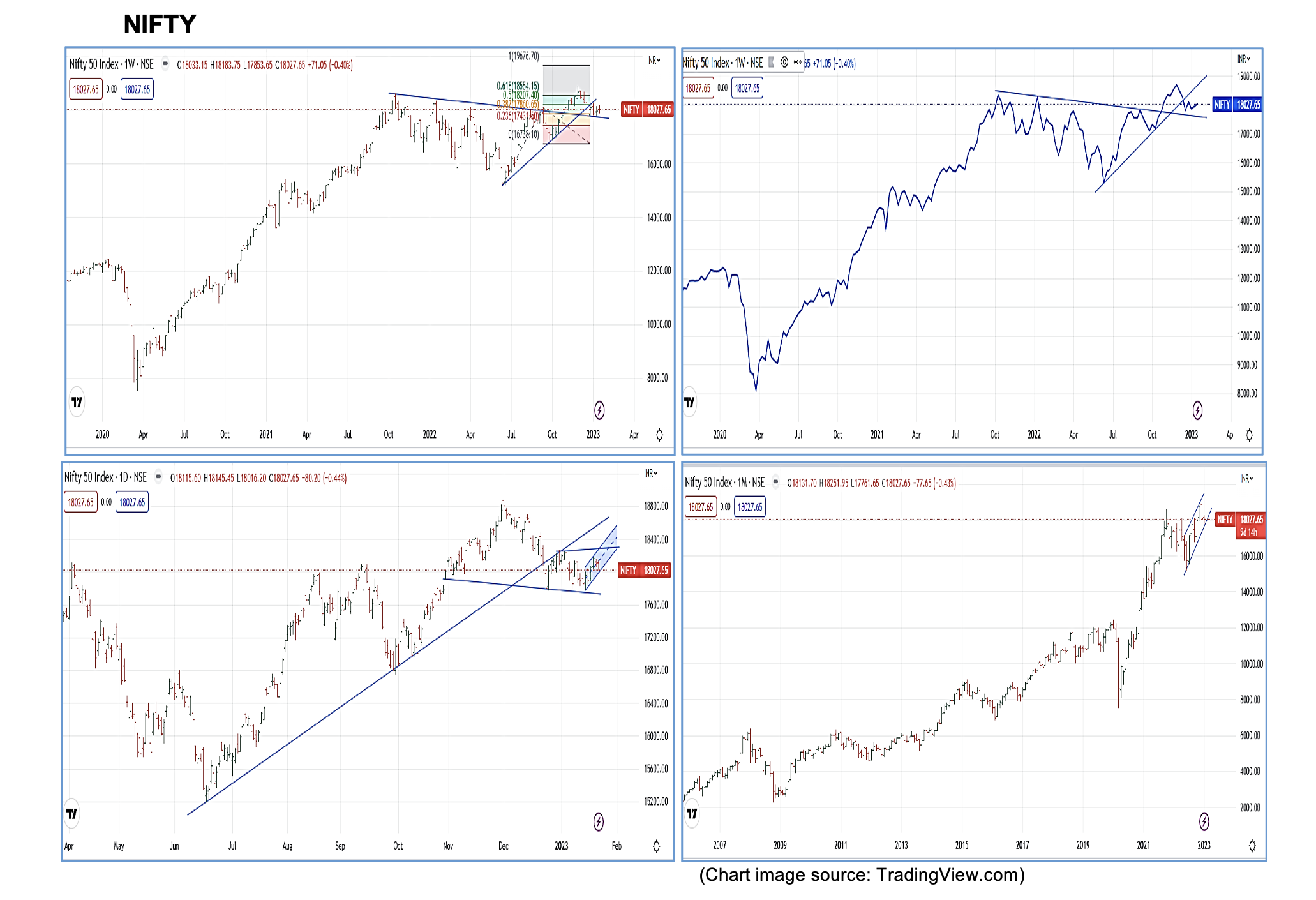

NIFTY :-

The main Index Nifty was under continued pressure on most of the sessions. The range is seen very much narrowed. Nifty ended up with yet another indecisive Doji candle on the weekly charts. However, it made higher highs and higher lows. The unusual calm is disturbing. We may see a break out during the ensuing week.

- A few observations from the weekly charts are:

- Weekly charts suggest that

- The index moved around 330 points viz. between 17853 and 18183

- the oscillators are showing mixed signals

- Monthly Option expiry due and the Option OI is expected to drive the market direction

- 17770-790 continues to be the crucial support zone

- Expected scenarios for the ensuing week

- Though closed at 18027, the Index is expected to open flat or higher

- For the ensuing week, the index may find supports at 17860, 17770 and the index could face resistances at 18180, 18270, 18360

- Additional interesting observations

- There seems slow down on selling by FIIs and DIIs were net positive

- Expected to continue in the range of 17770-18360

- Any close outside the range of 17770-18360 requires re-assessment of risk

US Markets

- DOW appears to have made a strong base at 32600

- Missed one opportunity to clear the barrier at 34500

- Expect the range of 32600-33600 to continue

- Final Note

- So far one of the smallest movement in a month Viz. between 17761 & 18251

- A truncated week with the Monthly Expiry due on 25th market to witness volatile sessions

- The next five sessions are crucial as Nifty is at a make or break situation and would show if the Bulls make good the last opportunity or make it a lost opportunity

- The consolidation phase seems to have got completed and preparing for the next move and the direction of this would be clear by the end of this week

- The crucial support at 17770 holding for the fifth consecutive week gives hope for some recovery and even a possible attempt closer to the recent peak.

- The Index seem to move 165 points on either side by taking 18020 as Pivot

- The technical factors indicate a mixed signal

- There are chances for upside if the Index closes above 18180 with sharp move to gather momentum

- If for any reason the support at 17770 breaks, then we may see a fall towards 17320 and the 17035

- Market may remain cautious ahead of the FED meeting on 1st of Feb 23

- Final Note

Bank Nifty:-

The Bank Nifty moved in 854 points range of 41861-42715 and made a bearish candle. The aggressive selling seems to have receded and the higher close seem to favour one possible attempt of 43350. There is not much of change in the scenario as we see the Index continuing to move in a channel with top at 44600 and lower end at 41700 with a pivot at 43100. This week is crucial to see whether the Bank Nifty holds crucial channel support at 41700-41800 zone. The scenario for now appears to be balanced with the base at 41700 holding for the fifth week in a row. Bank Nifty is likely to continue in a wider range of 41700-44200. The first trigger for the Bank Nifty to move higher would be a close above 42725 and subsequent trigger at 43360. For now, 41700 is the crucial level to be watched. A break on a closing basis would mean there is deeper correction ahead towards 40685 and then to 39800. A daily close outside the broader range indicated above would require re-evaluation.

USDINR:-

The pair came under continued selling pressure. While the pair attempted to scale higher of 81.88 levels, it got sold-off again. The crucial support at 81.10 also gave up. The momentum is likely to continue and any pull back towards the trend line resistance at 81.80 and 82.20 is likely to see selling pressure. Break below 80.90 can trigger further stops being hit to see the pair drift towards 80.50 and then to 80.20. Most likely scenario would be a consolidation between 80.20 and 81.50. A close outside this range requires re-assessment of risk/direction and target.

A few more observations:

- Steep trend line broken

- The correlation between DXY and USDINR is not currently active and any spike in DXY need not necessarily impact this pair

- though the Dollar Index-DXY is likely to hover in the familiar range of 102-105

- The raising upward channel indicate the broader range of 80.10-83.10

- The increased volatility and wild swings likely to continue

Gold :-

The precious metal is making a steady gain. As expected the breach above 1920 helped the Precious metal see further gains towards 1937. There may be selling pressure coming in around 1960-70 range. We can safely assume that the consolidation range got shifted higher with a band of 1860-1970 with 1910 acting as Pivot.

Crypto :-

They crypto assets have continued its gain and could manage to cover the highs of July 2022. Now that it has reached another crucial juncture. The appreciation is likely to continue till it achieves the June 2022 highs. The reactive pull backs are likely to be supported by fresh buying interest. Technically there are chances that it might manage to cross June high and cover half of the losses made in May 2022. Whether all negatives surrounding the Crypto assets is cleared is a big question. Yet there are chances that this move may help to regain the confidence of the investors.

Crude :-

Crude was seen in a narrow range of 78-82. The technical indicators point to a surge in crude price towards 95 levels. This could be due to change in perception about the revival of economic activities subsequent to encouraging inflation data. Any trigger beyond 90 would attract rhetoric on the recession concerns once again. Things would look fine as long as the Crude hovers around 75-85 range. Sounds safe for now as long as we see the crude move in this range of 70-90. Either extremes are likely to hurt the economic activities and the outlook.