Weekly Technical View

Technical Weekly View on NIFTY, BANK NIFTY, USD/INR, GOLD, CRUDE, CRYPTO

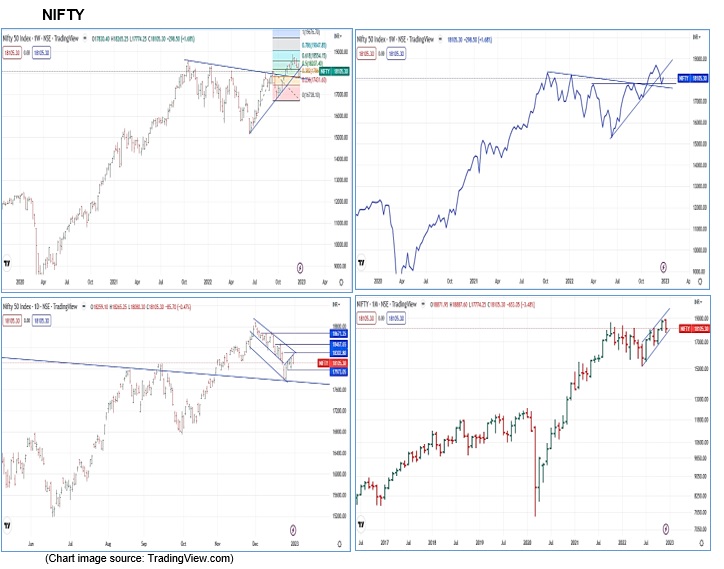

NIFTY :-

Nifty saw a remarkable recovery snapping the three weeks of steep fall. As observed in the previous blog the reversal was sharper aided by short covering. Nifty index completed the eventful year with a decent 4.33% gain during the year. With 17777 holding for two consecutive weeks, we may see a consolidation during the ensuing week.

A few observations from the weekly charts are:

- Weekly charts suggest that

- The index moved around 298 points viz. between 17774 and 18265

- the oscillators are showing mixed signals

- Option OI is expected to drive the market direction

- With 17770 holding the Index has made tweezer bottom and it ended up with a bullish candle

- Expected scenarios for the ensuing week

- Though closed at 18106, the Index is expected to open higher

- The support at 177770 held and the index has made a remarkable recovery

- A new Gap has been created viz. 18127-17977 got filled

- Going forward the 18350-18470 zone, is likely to be a major barrier

- For the ensuing week, the index may find supports at 18080, 17960, 17770, and the index could face resistances at 18180, 18270, 18360 & 18480

- Additional interesting observations

- Not any major changes seen in FIIs and DIIs activities except 15k Cr option buying during the past week

- Two possible scenarios

- Expected range of 17960-18470 or 17770-18360

- Any close outside the range of 17770-18470 requires re-assessment of risk

- US Markets

- DOW continues to move in a narrow range

- Appears that the Dow is caught in a range of 32500 and 33600. Only a breach on either side would decide further direction

- Expect a sharp up move during this week on break of 33600

- Final Note

- The crucial support at 17779 holding for two consecutive weeks give hope for some recovery and even a possible attempt closer to the recent peak.

- Even at the cost of repetition the following two observations are reference values for the future

- If we take the Fib retracements so far the correction has been 1108 points. The Annual gain has been 3704 points from 15183 to 18887. One third correction would fall at 17666 and a 50% correction would mean 17035

- Most likely scenario would be a consolidation between 18k-18.5k

Bank Nifty:-

The Bank Nifty managed a sharp recovery there by helping the main index recover. Bank Nifty as almost recovered previous week’s loss. We see the Index continuing to move in a channel with top at 44600 and lower end at 41800 with a pivot at 43100. This week is crucial to see whether the Bank Nifty holds crucial channel support at 41700-41800 zone for one more week. The scenario for now balanced and the Bank Nifty is likely to continue in a wider range of 41700-44200 with 43100 as pivot and a breach and close above or below could see the next range of 900 points. For now, 41700 is the crucial level to be watched. And break on a closing basis would mean there is deeper correction ahead towards 40685 and then to 39800. A daily close outside the broader range indicated above would require re-evaluation.

USDINR:-

The pair moved in a range of 81.55-82.92 during last week. The top at 82.96 remains same for the past 2 weeks there by making this a Tweezer top. There are chances that there could be stronger supply coming in at close to 82.95 and that the fresh flows could make the pair drift towards 82.44 and then to 82.10 support. Only a daily close below this would suggest further correction towards 81.90. Deeper corrections cannot be expected till we see a close below 82.10. Most likely scenario would be a consolidation between 82.20 and 83.20. A close outside this range requires re-assessment of risk/direction and target.

A few more observations:

- The pair has a characteristic of moving in a very narrow range and suddenly moves taking everyone by surprise

- We may not see a runaway in DXY. There can be relief rallies.

- Full impact of the correction has not yet been seen in USDINR currency pair. Hence, the spikes in DXY need not necessarily impact this pair

- The raising upward channel indicate the broader range of 80.10-83.10

- The increased volatility and wild swings likely to continue

Gold :-

The precious metal is seen consolidating in the range of 1790-1833. With 1800 holding, the outlook is expected to be positive. However, the precious metal seems to be making a cautious move. Any fall towards 1740 could be seen as opportunity for long. A daily close above 1840 would see further gains towards 1860+ For now, it appears like a consolidation between 1790-1840.

Crypto :-

For the seventh consecutive week the Crypto assets have seen a narrow range consolidation. We are witnessing choppy moves. Sharper moves are due during the ensuing week. There are possibilities of a sharp spike higher. We have been witnessing a sell-off on every spike. Whether the Gap seen in November 2020 spike is to be filled now or later is the major point to ponder and watch for action. Only a strong 20% sharp move can possibly help to regain the footing.

Crude :-

The Oil settled in a narrow range of 76-81. Things would look fine as long as the Crude hovers around 75-85 range. It has spent a longer time in the consolidation and there are probabilities for a spike towards 100 during the coming weeks. There are many uncertainties on the demand and winter worries. Sounds safe for now as long as we see the crude move in this range of 70-90. Either extremes are likely to hurt the economic activities and the outlook.